How Medicare Agent Huntington Ny can Save You Time, Stress, and Money.

Wiki Article

A Biased View of Medicare Agent Huntington Ny

Table of ContentsSome Known Facts About Medicare Agent Huntington Ny.What Does Medicare Agent Huntington Ny Mean?The Main Principles Of Medicare Agent Huntington Ny Rumored Buzz on Medicare Agent Huntington Ny

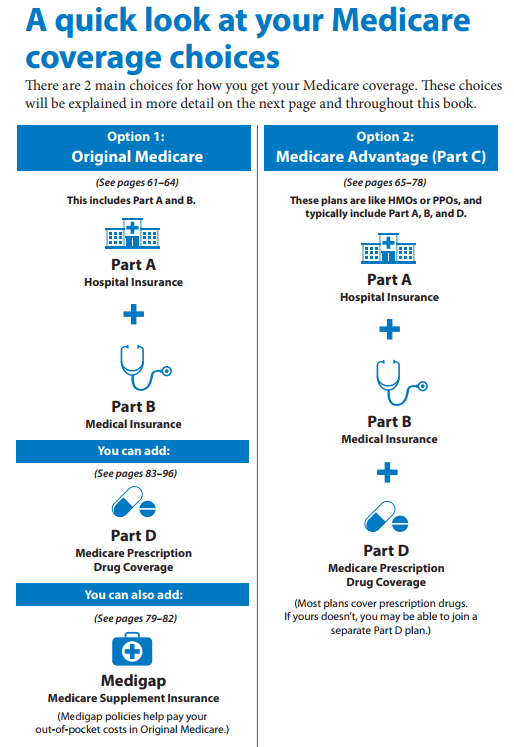

Navigating Medicare can be overwhelming, even if you have actually purchased your own health insurance in the past. You have numerous options to select from, consisting of Original Medicare, Medicare Benefit and Medicare Supplement Insurance. It takes some work to figure out which sort of Medicare is ideal for you, as well as which plan covers whatever you require.That's where a Medicare agent or broker can assist. These are licensed experts that can inform you about Medicare and aid you sign up in a strategy.

A licensed Medicare agent, often described as a broker, partners with wellness insurance coverage firms to aid you enroll in a Medicare strategy. To get accredited, a Medicare agent must know the ins as well as outs of Medicare, have the ability to compare plans, describe benefits as well as determine qualification. Typically, there is no cost to work with a Medicare broker.

There is never ever any responsibility to enroll in a strategy even if a representative has actually assisted you. Medicare representatives can provide details concerning the Medicare prepares offered to you. You not just have multiple kinds of Medicare available to you, like Original Medicare, Medicare Advantage and Medicare Supplement, however you likewise have a big selection of various strategies to pick from.

Medicare Agent Huntington Ny Fundamentals Explained

A Medicare broker can assist you tighten down your choices as well as pick the very best health insurance strategy for you. They'll ask concerning your: Health needs Budget plan Preferred medical professionals Drugs With this details, they can offer you with strategy alternatives that inspect all packages. When you pick a plan, a Medicare representative will certainly then stroll you through the enrollment process and also ensure that your application obtains sent to the medical insurance company for testimonial.The goal is to make you feel confident in your Medicare decision. At Quote, Wizard, we have a group of qualified and educated Medicare agents available to assist you.

They can break down the kinds of Medicare protection and discuss the advantages and disadvantages of each. From there, they can walk you via the strategies available in your area as well as discuss the benefits in detail.: We deal with the leading medical insurance firms in the country, whereas some Medicare brokers only collaborate with 1 or 2.

With more choices to select from, you're most likely to discover a strategy that's within your budget plan as well as meets your medical needs.: If you decide to enlist in a Medicare Supplement strategy (likewise called Medigap) and you're not in your Initial Registration Duration (IEP), you may be required to experience medical underwriting.

How Medicare Agent Huntington Ny can Save You Time, Stress, and Money.

: When you have actually chosen a strategy, our Medicare agents will certainly assist you complete the enrollment application. They will walk you with each area as well as make certain that it's precise and also full. From there, it will certainly be sent to the medical insurance firm for evaluation. If you wish to work with a Quote, Wizard representative, just telephone call (855) 906-0601.Quote, Wizard. com LLC has striven to make sure that the details on this website is appropriate, yet we can not ensure that it is cost-free of inaccuracies, errors, or noninclusions. All web content and solutions supplied on or with this website are supplied "as is" as well as "as available" for use. Medicare agent Huntington NY.

com LLC makes no depictions or guarantees of any type of kind, express or indicated, regarding the procedure of this website or to the info, material, products, or products included on this website. You specifically agree that your usage of this site goes to your sole risk.

Certified representatives (likewise understood as brokers) and also firms can help Medicare recipients select the appropriate insurance coverage. Agents are people that are qualified and signed up to solicit and enlist people right into insurance policy items. Medicare agent Huntington NY. Agencies provide administrative assistance such as marketing, innovation facilities, compliance, as well as other solutions for helpful hints agents. Medicare prepares agreement with representatives and also agencies to reach and sign up recipients; in return, agents make commissions directly from insurance providers.

Top Guidelines Of Medicare Agent Huntington Ny

For standalone Component D plans, the 2022 maximum nationwide compensation for novice enrollment is $87 and does not vary by area - Medicare agent Huntington NY. These commissions are paid when the beneficiary first enrolls in an MA or why not try this out Part D strategy. When a recipient is enlisted in an MA or Part D strategy, agents make a commission when the recipient changes to a brand-new plan or remains with the original plan.

CMS maximum compensation rates are established reduced for "switchers" and "revivals" 50 percent of the newbie compensation. For Component D, the nationwide optimum renewal payment is $44.

Report this wiki page